A Beginner's Guide to Reading and Analyzing Cryptocurrency Graphs

Introduction

In the fast-paced world of cryptocurrencies, understanding how to read crypto charts is essential for any investor or trader.Crypto charts provide valuable insights into the price movements, trends, and patterns of various digital assets.Whether you're a novice or an experienced trader, mastering the art of interpreting crypto charts can significantly enhance your decision-making abilities and increase your chances of success in the crypto market.

How to Read Crypto Charts

Cryptocurrency charts are graphical representations of the price data of a particular digital asset over a specific time frame. These charts display various data points, such as the opening price, closing price, highest price, and lowest price, among others. To read crypto charts effectively, you need to understand the key elements and indicators used in these charts. Let's delve deeper into the essential aspects of reading crypto charts.

Candlestick Charts: The Foundation

Candle outlines are generally utilized in crypto exchanging and give a far-reaching visual portrayal of cost developments. The body of the candlestick indicates the opening and closing prices, while the wicks or shadows represent the highest and lowest prices during that period.

Support and Resistance Levels: Identifying Key Price Zones

Backing and opposition levels assume an urgent part in the specialized examination. Support levels indicate the price level at which a cryptocurrency tends to find buying pressure, preventing it from further declining. Resistance levels, on the other hand, represent the price level at which a cryptocurrency faces selling pressure, hindering its upward movement. Identifying these key price zones can help you make informed trading decisions.

Trend Lines: Unveiling Market Direction

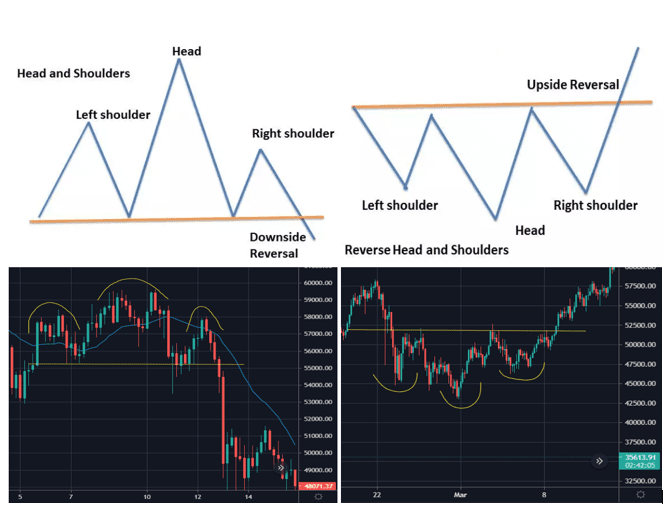

Trend lines are invaluable tools for assessing the overall market direction of a cryptocurrency. They help you identify whether the price is trending upward (bullish), downward (bearish), or moving sideways (consolidation). Drawing pattern lines requires associating sequential more promising low points in an upturn or worse high points in a downtrend.

Moving Averages: Smoothing Out Price Fluctuations

Moving averages are commonly used to smooth out price fluctuations and identify underlying trends. The most famous sorts of moving midpoints are the straightforward moving normal (SMA) and the remarkable moving normal (EMA). The SMA calculates the average closing price over a specific period, while the EMA places more weight on recent price data.

Volume Analysis: Understanding Market Activity

Volume investigation includes looking at the exchanging volume going with cost developments. High volume often confirms the strength of a trend, indicating a significant number of participants actively buying or selling the cryptocurrency. Low volume, on the other hand, may suggest a lack of interest or indecision in the market.

Indicators and Oscillators: Supplementing Analysis

In addition to the foundational elements mentioned above, there are numerous indicators and oscillators available to supplement your analysis. Some famous ones incorporate the Overall Strength File (RSI), Moving Normal Combination Uniqueness (MACD), and Bollinger Groups. These tools can provide additional insights into overbought or oversold conditions and potential trend reversals.

FAQs about How to Read Crypto Charts

Q: How long does it take to learn how to read crypto charts?

Learning to read crypto charts is an ongoing process that requires practice and continuous learning. While you can grasp the basics relatively quickly, becoming proficient in chart analysis takes time and experience.

Q: Are there any free resources available to learn about crypto chart analysis?

Yes, there are several free resources available online to learn about crypto chart analysis. Websites like Investopedia, CoinMarketCap, and YouTube channels dedicated to cryptocurrency often provide educational content on reading crypto charts.

Q: Can I use crypto chart analysis for short-term trading?

Yes, crypto chart analysis can be highly effective for short-term trading. By analyzing price patterns, trends, and indicators, you can identify potential entry and exit points for your trades.

Q: What are the dangers implied in crypto exchange?

Crypto trading involves risks, including the volatility of cryptocurrency prices, regulatory uncertainties, and cybersecurity threats. It's important to conduct thorough research, manage risk through proper portfolio diversification, and stay informed about the latest developments in the crypto space.

Q: Is it possible to make a consistent profit by reading crypto charts?

While reading crypto charts can enhance your trading skills, it's essential to remember that the crypto market is highly volatile and unpredictable. Consistent profitability requires a combination of technical analysis, risk management, and a deep understanding of market dynamics.

Q: What should I do if I don't understand a particular chart pattern?

If you come across a chart pattern that you don't understand, it's advisable to seek additional information or consult experienced traders. Joining online forums or communities dedicated to cryptocurrency can provide valuable insights and guidance.

Conclusion

Mastering the art of reading crypto charts is a valuable skill for anyone interested in cryptocurrencies. By understanding the various elements of crypto charts, including candlestick patterns, support, and resistance levels, trend lines, moving averages, volume analysis, and indicators, you can gain a competitive edge in the crypto market. Remember to continuously educate yourself, practice chart analysis, and stay updated with the latest market trends. With dedication and perseverance, you can improve your decision-making abilities and increase your chances of success in the exciting world of cryptocurrencies.

.jpg)

Comments

Post a Comment